yet.

yet.

Following several relatively tranquil months when the S&P 500, recovering from a brutal selloff in late 2018, quietly notched higher and higher levels, August brought back a sense of uncertainty to the stock market—and with it, the volatile price swings that come when investors grow more jittery.

And jittery they are. Stock volatility is often measured by the Chicago Board of Exchange’s Volatility Index, or VIX. The VIX rose as high as 24.59 in early August and has hovered just below the 20 level since then. That’s not as high as the 36 level the VIX reached last December, but it reflects a higher volatility than U.S. stocks have seen so far in 2019.

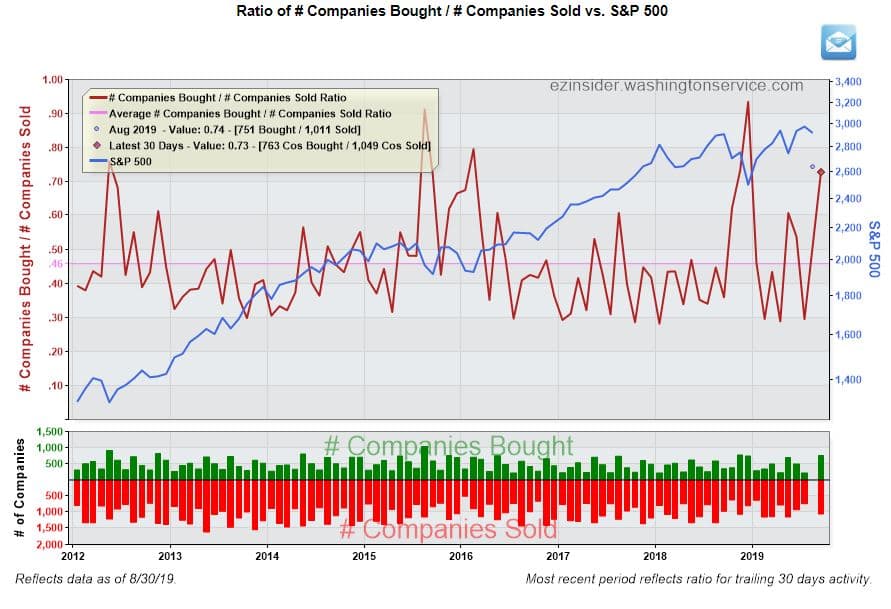

The index averages as always don’t tell the whole story. Some stocks more susceptible to an economic slowdown were brutally punished, prices plunging 30 %. Other defensive names like utilities and REITS reached all-time highs as interest rates collapsed around the world. A large portion of sovereign debt is carrying a negative yield. That’s right- you give the bank a $1 million dollars for safekeeping and you get less than that back in 10 years. Don’t ask me to explain that, I can’t. I haven’t even heard any noted economists explain it either. It’s definitely unchartered waters. The underlying nonsensical bond yields are adding to a sense of foreboding and doom amongst market participants. Insiders bought aggressively in energy, pipelines, some REITs, and healthcare names. To see the full report, go to https://www.theinsidersfund.com/2019/09/insiders-8-31-19/