There are superstars in every industry that master their craft and turn into legends. Names that are associated with incredible feats, discoveries, and successes will live on for centuries to come, and this phenomenon extends to investors as well.

Great investors can almost be thought of as the celebrities of the financial world. They’re often the people who inspire others to improve their strategies, and they can even have an influence on the markets. Unlike the big names in science and business (think Nikola Tesla, Albert Einstein, Henry Ford, and Jeff Bezos), the greatest investors aren’t as well-known by the public.

These “greats” used different philosophies and strategies to earn their recognition and their returns; some of them were innovators who came up with new ways to do investing, while others followed their guts and relied on their instincts to get to the top.

Though there are hundreds of incredible investors whose stories could be told, this article will focus on five of the best. Keep reading to learn about some of the best investors of all time and what kind of returns they saw in their lifetimes.

Benjamin Graham

Benjamin Graham is the author of two “Bibles” of investing and one of the best financial educators and investment managers to ever live. His most famous work, The Intelligent Investor, is considered to be a must-read for anyone who wants to deal in the stock market. Along with being recognized as the writer of two classic books on investing, he is also universally considered to be the father of two fundamental investment disciplines—value investing and security analysis.

His entire investing philosophy was based on investor psychology, minimal debt, fundamental analysis, concentrated diversification, buy-and-hold investing, and contrarian mindsets. Graham defined what it means to be a value investor and claimed that any investment should be worth more than what the investor has to pay for it.

He was a big believer in fundamental analysis and always looked for businesses with solid balance sheets or ones with little debt, decent profit margins, and ample cash flow. The earnings he got from his work in the financial market are not clear, however, it is speculated that his net worth was less than one might expect. This is likely the result of Graham’s relative lack of interest in growing his own personal wealth, as he focused more on innovation and academic pursuits.

His work and teaching inspired many other investors, including other all-time greats such as Warren Buffet, Charles Brandes, and William J.Ruane. Along with his influence on investing, Graham also made contributions to the field of economic theory and notably devised a new basis for the U.S. and global currency as an alternative to the well-known gold standard.

He considered this currency theory to be his most remarkable work, even though it was widely disregarded while he was alive and gained recognition years after his death, during the aftermath of the 2008 Financial crisis.

Sir John Templeton

John Templeton is most well-known as the founder of the Templeton Growth Fund. He was a mutual fund manager and contrarian investor. In 1939, Templeton purchased shares of every company that was trading below $1 on the NYSE. That led him to buy 100 shares each in 104 businesses in total, meaning his entire investment was no more than $10,400.

During the next four years, 34 of the companies that he purchased shares from went bankrupt. However, he was still able to sell his entire portfolio for $40,000. This helped him recognize the value of diversification and investing in the market as a whole because, as he saw, while some companies fail, others will gain.

Over the years, he created some of the most successful international investment funds; he sold the Templeton Fund to the Franklin Group in 1992. Over the course of 38 years, from 1954 to 1992, Templeton funds had an annual return of 14%, which indeed tells you everything you need to know about how well he understood the market.

John “Jack” Bogle

Jack Bogle is well-known for being the founder of the Vanguard Group, which is often associated with low-cost mutual funds. However, Bogle’s work as an investor didn’t begin there. After he graduated from Princenton, Jack Bogle started working for Wellington Management Company, where he managed to become Chairman in a short period of time. Unfortunately, because of a bad merger, he was fired, but thankfully for his future, he learned many valuable lessons during his time there.

In 1975, Bogle founded the Vanguard Group and pioneered the no-load mutual fund, which eliminated the reliance on third-party brokerages and so didn’t have to charge a sales commission. He also created the first index fund available to the public, Vanguard 500, and had the goal of matching the famous S&P 500 in exchange for a minimal fee. Bogle’s approach, which has only gotten more popular thanks to the rise of exchange-traded funds, enables investors to get their returns without having to pay a ton of money in fees.

In 2020, when the pandemic hit, Bogle’s Vanguard became even more popular. At the time of his death in 2019, the mutual fund had $4.9 trillion in assets, and now its value has gone over $7 trillion.

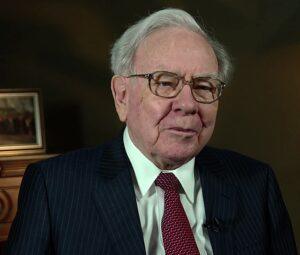

Warren Buffett

It would be a crime to make a list of the best investors of all time and not include perhaps the most famous and successful investor in recent history—Warren Buffett. Often called the “Oracle of Ohama,” Buffett is a household name, which isn’t the case for many of these successful investors.

Buffett followed the principles that his teacher, Benjamin Graham, set during his lifetime and has gained a multibillion-dollar fortune ($117 billion) by buying stocks and companies through Berkshire Hathaway. In fact, the people who first believed in him and invested $10,000 each in Berkshire Hathway in 1960 now have fortunes of their own.

There’s a lot that can be said about Buffett’s investment style—it’s all about patience, discipline, and adding value consistently without taking on too much risk or getting caught up in trading. His focus is very simple to understand—he buys businesses at a low price, invests in improving them by making the needed changes, and reaps the benefits of the long-term stock price improvements (also referred to as value investing). Buffet looks for companies in industries that he understands and can bring value to, and so he’s able to realize excellent returns with an annual average of about 20%.

Carl Icahn

Carl Icahn is an activist investor who uses his ownership positions in publicly held companies to make the needed changes that increase the value of the company’s shares over time. When he first started becoming famous in the late 70s and early 80s, Icahn gained the reputation of being a “corporate raider”—a person that engineers hostile takeovers of businesses and then slashes costs and sells assets so that he can increase the value of that same company’s shares.

Icahn is known for putting his focus on companies that he believes are undervalued due to poor management and often looks to force changes related to those companies’ management teams and their governance.

He is also famous for the so-called “Icahn Lift,” a Wall Street catchphrase used to describe the increase in value of a company’s stock price that occurs once Carl Ichan begins to buy shares of that company’s stock. Along with that, regardless of whether you agree with his tactics or not, Carl Ichan has some of the largest annual returns on his investments—a whopping 31% from 1968 to 2011, which makes him one of the most successful earners on the stock market.

In Conclusion

There are many incredible investors who have left their mark on the world of finance and the stock market. The people we discussed in this article were pioneers in their own unique way and managed to achieve incredible success over the course of many decades.

All of their individual stories prove that if you’re genuinely passionate about your craft and dedicate yourself to growing your knowledge and experience, you can make great things happen. Hopefully, learning about these investors and their financial journeys inspired you to take the leap and start your own.

If you’re interested in growing your wealth or learning more about your investment options, contact the experts at Alpha Wealth Funds today.

Please feel free to reach out to me on this or any of your investment needs or questions. I may not always have the answers at my fingertips, but I promise I will get them for you. Harvey Sax

Founded in 2010, our services include boutique hedge funds, separately managed accounts, financial planning, estate & trust services, private placements, and in-house concierge services for high net worth individuals, families, and businesses.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All investments involve risk including the loss of principal.