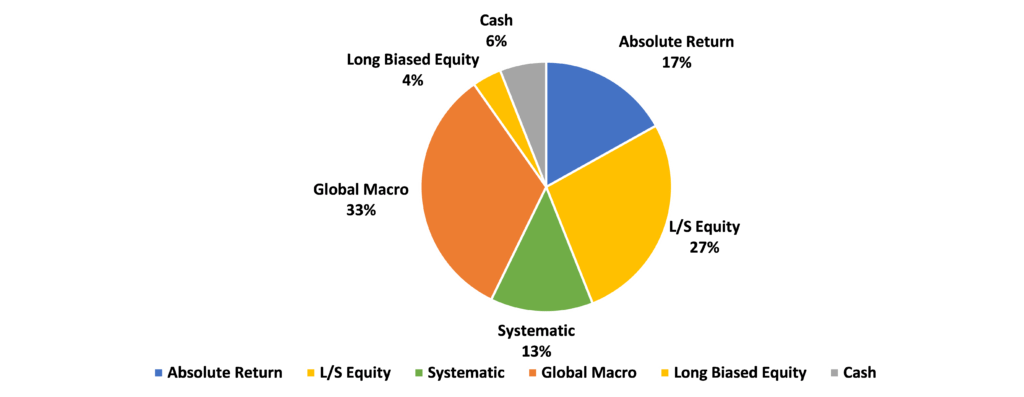

Alpha Diversified Fund Positioning 5/1/2023

Absolute Return Discussion

Can an absolute return strategy help you avoid the common mistakes of other investors?

The popularity of the absolute return strategy has ebbed and flowed over time, with its attractiveness largely dependent on market conditions and investor sentiment. During market volatility or uncertainty, the absolute return approach may become more popular when traditional equity strategies underperform. Conversely, during times of market stability and optimism, traditional equity strategies may be more attractive to investors.

Recently, there has been renewed interest in absolute return strategies, particularly as investors look for ways to manage risk and generate returns in an environment of ongoing economic uncertainty in financial markets, which may make an absolute return strategy more appealing to some investors. The global economic environment remains uncertain and volatile, with ongoing trade tensions, geopolitical risks, and the war in Ukraine. Traditional equity strategies may be more vulnerable to market volatility and downturns in this environment. An absolute return strategy, designed to generate positive returns regardless of market condition, may offer a more reliable and consistent approach to investing.

An absolute return strategy is an investment approach that aims to generate positive returns over a specific period, regardless of market conditions. Unlike traditional investing, which focuses on outperforming a benchmark index or market, an absolute return strategy seeks to achieve a positive return with a low correlation to any specific market or index. While there is no one-size-fits-all investment strategy that is universally superior to all others, an absolute return strategy has several advantages that can make it an excellent choice for certain investors and investment goals.

By focusing on achieving a specific level of return rather than trying to beat a benchmark, absolute return investors can generate steady, reliable returns over the long term. Another advantage of an absolute return strategy is that it can offer greater diversification and risk management than other investment approaches. By investing in various asset classes and using hedging techniques, absolute return fund managers can reduce their exposure to market risk and limit potential losses. This can be especially valuable in times of economic uncertainty or recession when traditional equity strategies may be more vulnerable to market downturns.

Finally, an absolute return strategy can be more flexible than other approaches, allowing fund managers to adjust their portfolios to changing market conditions or take advantage of specific opportunities as they arise. This can help managers stay nimble and adaptable in a constantly evolving investment landscape, allowing them to capitalize on emerging trends and avoid potential pitfalls.

The success of an absolute return strategy relies heavily on the manager’s ability to identify and exploit investment opportunities across various asset classes and markets, manage risk effectively, and adapt to challenging market conditions. The manager must have a deep understanding of different investment strategies, asset classes, and market conditions and the ability to manage risk effectively. The manager’s role in an absolute return strategy is critical as they make investment decisions and manage the portfolio’s assets. Therefore, the manager must have a clear investment mandate and well-defined investment process, including risk management protocols, to ensure the strategy is executed consistently. Moreover, an absolute return strategy requires active management, as the manager must continuously evaluate and adjust the portfolio’s holding based on changing market conditions and investment opportunities. This requires a high level of skill and expertise and the ability to react quickly to changing market dynamics.

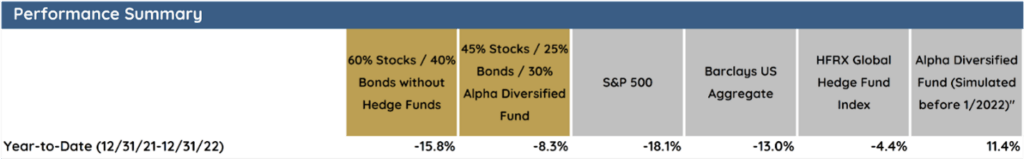

As a testament let’s take a look at what happened in 2022:

In the short-term a 30% allocation to an Absolute Return investment limited the downside of a year where both stocks and bonds declined substantially. Over a longer period, positive contribution from an absolute return investment will enhance returns and lower overall volatility.

We at Alpha Diversified Fund assist qualified clients in achieving superior risk-adjusted returns by providing access to a diversified absolute return strategy as an alternative to core assets, helping to increase diversification, lower portfolio volatility, and preserve capital.

Alpha Wealth Funds | Mark Kress, CFA | 415-290-7164 | mkress@alphawealthfunds.com | www.alphawealthfunds.com

Disclaimer- Information provided reflects Alpha Wealth Funds views as of the date of this document. Such views are subject to change at any point without notice. The information contained herein is for informational purposes only and should not be considered a recommendation to buy or sell any securities. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based on any information provided herein. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Asset allocation and portfolio diversification cannot assure or guarantee better performance and cannot eliminate the risk of investment losses. Past performance is not necessarily indicative of future performance. There can be no assurance that the performance achieved above will be achieved at any time in the future. All investments involve risk, including the loss of the entire investment.