Hemp CBD Is a Bust. Farmers Are Disappointed.By Bill AlpertJan. 31, 2020 10:00 am ETOrder ReprintsPrint ArticleText sizeThe 2020 planting season for hemp is approaching. Photograph by Miguel Medina/AFP via Getty ImagesMany farmers planted hemp last year, hoping for a bit of the billions in sales predicted for the newly legal, nonintoxicating variety of cannabis that yields the soothing stuff called CBD. But demand didn’t materialize, so piles of hemp “biomass” sit unsold, and the price of what does sell fell about 30% from December to January, according to researchers at New Leaf Data Services.It’s a glut and it is going to get worse. “[Large volumes of biomass remain unsold,” says New Leaf’s Hemp Benchmarks report for January, “suggesting that further price erosion is possible.”

Source: Hemp CBD Demand Is Poor. Prices Are Falling, in a Blow to Farmers – Barron’s

It’s not just farmer’s and hemp prices falling but the steady decline of publicly traded marijuana companies is one of the big untold stories of 2019.

It really didn’t take much foresight to know that most all things in the near to long term for marijuana were going to be a bust for stock market investors. A casual examination of a half dozen or less of the financial statements of the leading companies in the space, showed that no one made money, worse yet; no one was on the path to profitability. Now with jail time reduced and financial penalties less onerous, it remains uncertain when that profitability will come because it’s cheaper and perhaps even better quality to buy the black market flower than the heavily taxed and regulated kind. I should point out this is not first hand knowledge but rather an informed opinion from the cognoscenti who partake regularly. I have on first hand knowledge that you can buy black market pot at half the cost and better quality. Don’t ask me how I know this. I don’t divulge my sources.

Furthermore, the potency of marijuana aka cannabis has been enhanced a hundred time fold in the last 40 years- give credit to the truly American biotech growth industries. Many of our Ph.D biochemists have lent their formidable intellect into enhancing and delighting users with ever more potent and long lasting strains of the magic herb. Today, a hit or even two from a biogenetic engineered strain is enough to send one off to wonderland for the evening. A marijuana vape pen is ample enough to last the casual smoker six months to a year. It is not even the growth industry of tobacco in the long run as users will need less and less quantities to get the same results, stoned out of your mind.

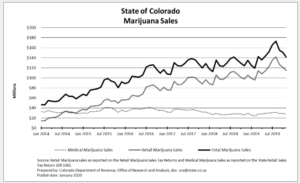

Worse yet for investors, the growth rate of revenue growth for the industry in places like Colorado where it has been legal for some time, is dramatically tapering off to something that looks far less glamorous. The Marijuana state sales report from Colorado shows a 27% year over year growth rates but the rate of growth is clearly tapering off.

As surrounding states legalize the herb, one can only guess at what the true long term growth rate is for the fanciful weed. My estimate is that the long term growth rate will be comparable to other commodity crops, in line with population growth. Yet that doesn’t mean there won’t be winners. Brown Forman, Constellation Brands, and Altria do just fine peddling vice but they for the most part don’t trade at stratospheric multiples. For now the winners are the short sellers. There is one simple way to still short the group and that is by selling the ETFMG Alternative Harvest ETF, MJ. It”s three month total return is -10.72%. It still has a long way to go down.

Remember the First Rule of Vice Investing “DON’T GET HIGH ON YOUR OWN SUPPLY”